Customer experience has become an integral part of any business, including banks. Increasingly, it is becoming a key differentiator besides price and product.

In the banking industry, customers prefer to work with banks that provide them with simple banking solutions, personalized engagement, and round the clock access to their accounts. As such, banks that innovate in a way that addresses the needs of customers and provide them with positive experiences have a substantial competitive edge compared to those that don’t.

In a business environment where customer behavior and technology are constantly evolving, how can banks provide customers with delightful experiences that keep them coming back?

This article helps you find answers to:

- What is customer experience in banking all about

- What is the importance of a good banking experience

- How can you excel at providing exceptional banking experiences

What is Customer Banking Experience

Customer experience in the banking sector revolves around how your customers perceive the banking services you provide. It encompasses everything right from the quality of service, your support staff’s engagement with customers, how you address customer queries, the mobile app experience, how seamless your online transactions are, and much more.

All of this combined makes for an excellent customer banking experience.

Why Is Good Banking Experience Important?

The quality of customer service, competitive pricing, and value for money are the three major factors that form a crucial part of good banking experience.

The digital age has made everything so easy and accessible that all it takes is a click to switch banks. Customers are spoilt for choice, with the online marketplace presenting them scores of options to choose from.

In a scenario like this, providing unmatched banking experiences is not a choice. It’s a prerequisite to gain customer loyalty and establish credibility in the market.

How to Provide Exceptional Banking Experiences?

1. Empower Customer Service Staff with a Well-Organized Knowledge Base

Customer service teams are among the frontline staff in any bank. For them to succeed in their jobs, they need to have the right resources. However, this is not always the case.

Often, many banks fail to provide their customer support staff with the tools and information they need to engage and resolve tickets effectively. This not only results in poor customer service but also lowers customer morale.

Usually, the important information that customer support staff need to respond to customer queries effectively is found in lengthy policy documents or can only be availed by talking to senior people in the bank.

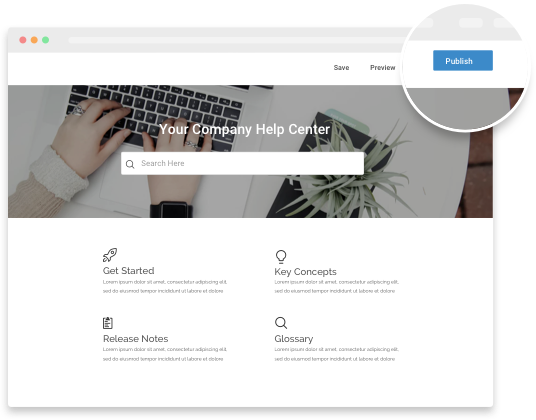

One way to empower the squad of support professionals is through the use of a knowledge base. As a centralized information database, a knowledge base can help banks continually improve customer service simply by giving operators round the clock access to valuable information.

This can include data related to products, solutions to issues that customers face frequently, and relevant procedures and processes that would make their work easier. To effectively support customer-facing staff, a knowledge base should be organized in a way that makes retrieval and sharing of information effortless.

A knowledge base that is poorly organized will only confuse the support staff. Finding the information they need will become a challenge, affecting their confidence levels. To avoid this problem, businesses that choose to empower their customer support team should ensure their knowledge base is:

- Easily accessible

- Has relevant, accurate and up-to-date information

- Have a search function that makes information gathering effortless.

2. Provide Customers with Consistent Information on All Communication Channels

According to a banking survey, providing customers with positive experiences across multiple communication channels is one of the areas that banks need to improve. With technological advancements now allow people to undertake banking activities online on mobile devices, customers expect to receive good customer service when on the move.

As such, banking institutions need to find ways to respond to the queries submitted through different communication channels and maintain consistency in their responses.

One way to improve customer experience in the banking industry across different communication channels is through the use of help desk software. Businesses that use help desk software are able to manage requests submitted by customers through a ticket management system. It helps in consolidating the requests that customers submit via different channels into a central place and directing them to specific departments.

By doing this, the software ensures that no requests fall through the cracks, and all issues are resolved in a timely manner.

Banks can also make use of live chat software to provide an excellent experience to their customers. The software helps in delivering instant responses to customer questions, as and when they arise. In case questions aren’t solved through chat, customers can then raise a ticket, which then goes to a bank’s help desk.

3. Make Use of Fintech

Banks struggle with the need to comply with strict financial regulations while meeting the need of customers to access banking services wherever they are. This gap has fueled the growth of fintech innovations, which banks can utilize to stay ahead of the curve and improve customer satisfaction.

Some interesting ways through which technology is improving the provision of banking services include:

- Increasing security through the use of biometrics like eye scans and voice identification

- The use of customer data to boost customer targeting in bank marketing

- Digitization of old data

- Integration of digital wallets

- Provision of mobile banking options

- Installation of video teller devices

A great example of banks that are using technology to improve customer experiences in banking is Simple Bank. This bank has everything online and does not have branches. Its fintech idea is built on the premise of helping busy users track their money without experiencing red-tapism.

The bank achieves this by allowing customers to control every aspect of their bank account via an app. Using the app, customers track their accounts and manage their budgets from one place. For cash transactions, customers can use a wide range of partner ATMs.

Another bank, BMO Harris Bank, has tapped interactive technology in its ‘Smart Branch‘ innovation. This innovation features video tellers where tellers interact with customers via screens and Smart ATMs for mobile cash withdrawals.

4. Provide a Financial Literacy Program

Banks provide financial services to a broad spectrum of customers. These customers range from those with high financial literacy to those whose knowledge in financial matters is not as high.

Though people desire to make better financial decisions that put them on the path to success in the future, many have not had a chance to learn how they can do this. The need for financial literacy is dire in the US with statistics showing that ⅔ of American adults cannot pass a financial literacy test.

This can be seen by the increase in credit card debt in households. Existing statistics show that due to the rise of easy credit, the average credit card debt in households increased by 25%, from $6,642 in 2011 to $8,284 in 2018.

To provide customers with excellent customer experience in banking, banks should consider running financial literacy programs.

Bank of America is a classic example of banks that have integrated financial literacy programs in its outreach. The bank uses video tutorials to empower its customers with financial literacy skills and has partnered with the Khan Academy in this program.

On the other hand, Sberbank, a Russian bank, utilizes an artificial intelligence tool known as TIPS to improve the financial habits of its customers. The tool analyzes the banking habits of each customer and generates personalized estimates of what might happen in the future.

With this information, customers can set their financial goals and access the best banking products to achieve those goals. The tool consolidates everything in a central place, making banking easier for clients, thus improving customer experience in the banking industry.

5. Don’t Just Lend to Small Business Enterprises, Advise Them

After the 2008/9 recession, small businesses are not just looking for banks to give them money; they want to partner with banks. This need among small businesses creates a unique opportunity that most banks are yet to innovate around in order to transcend the conventional lending roles that they are associated with.

Banks that have managed to add an advisory service for small business enterprises have been able to create an extra revenue stream as they charge a fee for those services. Lead Bank in Missouri is one such bank. The Garden City-based bank started providing small businesses with capital raising, strategic planning, and bookkeeping services in addition to conventional lending and deposit services.

6. Provide a Self-Service Portal

Today, more than ever, customers prefer to resolve their issues by themselves. Corporate giants such as Google and Amazon have conditioned people to get what they wish when they want. Statistics show that 81% of customers try to address issues by themselves before they reach out to a customer representative. According to a 2017 Microsoft report, 77% of customers say they have used self-service portals to resolve their issues.

However, most banks are yet to offer customers self-service support. Instead, they limit customers to the use of phone calls or branch visits to have their issues resolved. Banks that want to provide customers seamless experiences need to focus on providing self-service portals where customers can conveniently find what they need.

There are several benefits that banks can derive by integrating self-service in their customer support strategy. These include:

- A reduction in the number of support calls – Most customers can resolve issues on their own

- Round the clock support – Customers can find answers to their queries even when the bank is closed at night and during weekends

- Fast issue resolution – customers don’t have to be on hold to talk to customer representatives and have them resolve their issues

With 60% of customers in the US saying their preferred channel of getting simple inquiries responded to being digital self-service tools, banks should focus on making such tools such as website FAQs, help centers, and mobile apps available.

7. Personalize Customer Support

Businesses in all sectors are operating in a highly competitive environment, and retail banking is not an exception. However, for the banking industry, building customer loyalty is a challenge due to the injury caused by the 2008/9 recession that reduced customer trust in banks significantly.

One way to rebuild this trust and put customers at ease is through personalized customer support. Considering the amount of data that banks hold about their customers, there are numerous personalization opportunities to tap. These include:

- Using customer names in every communication

- Providing customer service through the channels that customers prefer

- Recommending bank products or services based on the history of the customer’s associations with the bank

- Creating and implementing a loyalty program where loyal customers get rewarded

In a nutshell, the personalization of messages and services makes clients feel valued, which in turn improves the way they experience the banking services that are offered to them.

Bottomline

Customer experience is an essential aspect of growing any business because it is the factor that determines customer loyalty. With the growing competition and changing customer behavior, improving the customer experience in banking needs to be a priority for financial institutions, including banks. Technology can play a crucial role in facilitating this process, and implementation of the seven points discussed above can help banks give customers positive experiences every time they interact with the bank.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!