Knowledge is the most valuable currency in the finance world, but when that knowledge is scattered across spreadsheets, buried in email chains, or locked away in the minds of individual employees, missed opportunities and costly errors creep in.

Knowledge management in finance helps transform the way financial institutions operate. By systematically capturing, organizing, and sharing critical information, it enables teams to make informed decisions, streamline processes, and mitigate risks.

In this blog, we’ll explore the crucial role of knowledge management in finance, delve into its essential elements, discuss its importance in today’s dynamic financial landscape, and examine the challenges organizations face in implementing it effectively.

What Is a Knowledge Management System in Financial Institutions?

A knowledge management system (KMS) in finance is a centralized platform that is a single source of truth for all critical information. This includes financial regulations, internal policies, market data, investment strategies, risk management procedures, and customer interaction guidelines.

A knowledge management system in finance goes beyond simple document storage. It facilitates team collaboration, enabling them to share insights, best practices, and lessons learned. This fosters a continuous learning and improvement culture, which is crucial in the dynamic financial landscape.

For example, imagine a bank with a vast network of branches. A KMS can ensure that all employees, from tellers to investment advisors, can access consistent and up-to-date information on products, services, and regulations.

What Are the Key Elements of a Knowledge Management System in Finance?

A knowledge management system in a financial institution is more than just a repository for data; it’s a strategic tool that empowers informed decision-making, enhances collaboration, and drives efficiency. Here are its key elements:

Centralized Knowledge Repository

A secure and easily accessible platform to store and organize all critical financial information, including regulations, policies, market data, and research reports. This ensures everyone can access the same up-to-date information, reducing errors and promoting consistency.

Collaboration Tools

Features that enable seamless communication and knowledge sharing among teams and departments. This encourages a collaborative environment where employees can exchange ideas, learn from each other’s experiences, and contribute to a collective pool of knowledge.

Workflow Automation

Automating routine tasks such as document approval, data entry, and report generation. This frees employees’ time to focus on more strategic activities like analysis and decision-making.

Version Control & Archiving

Maintaining a clear history of changes made to documents and data, ensuring accuracy and accountability. Securely archiving older versions of documents for compliance and audit purposes.

Robust Search Functionality

A powerful knowledge base search engine that allows users to quickly and easily find the information they need, even within a vast repository of financial data and documents.

Security & Access Control

Implementing robust security measures to protect sensitive financial information and ensure compliance with regulatory requirements. This includes access controls, encryption, and audit trails.

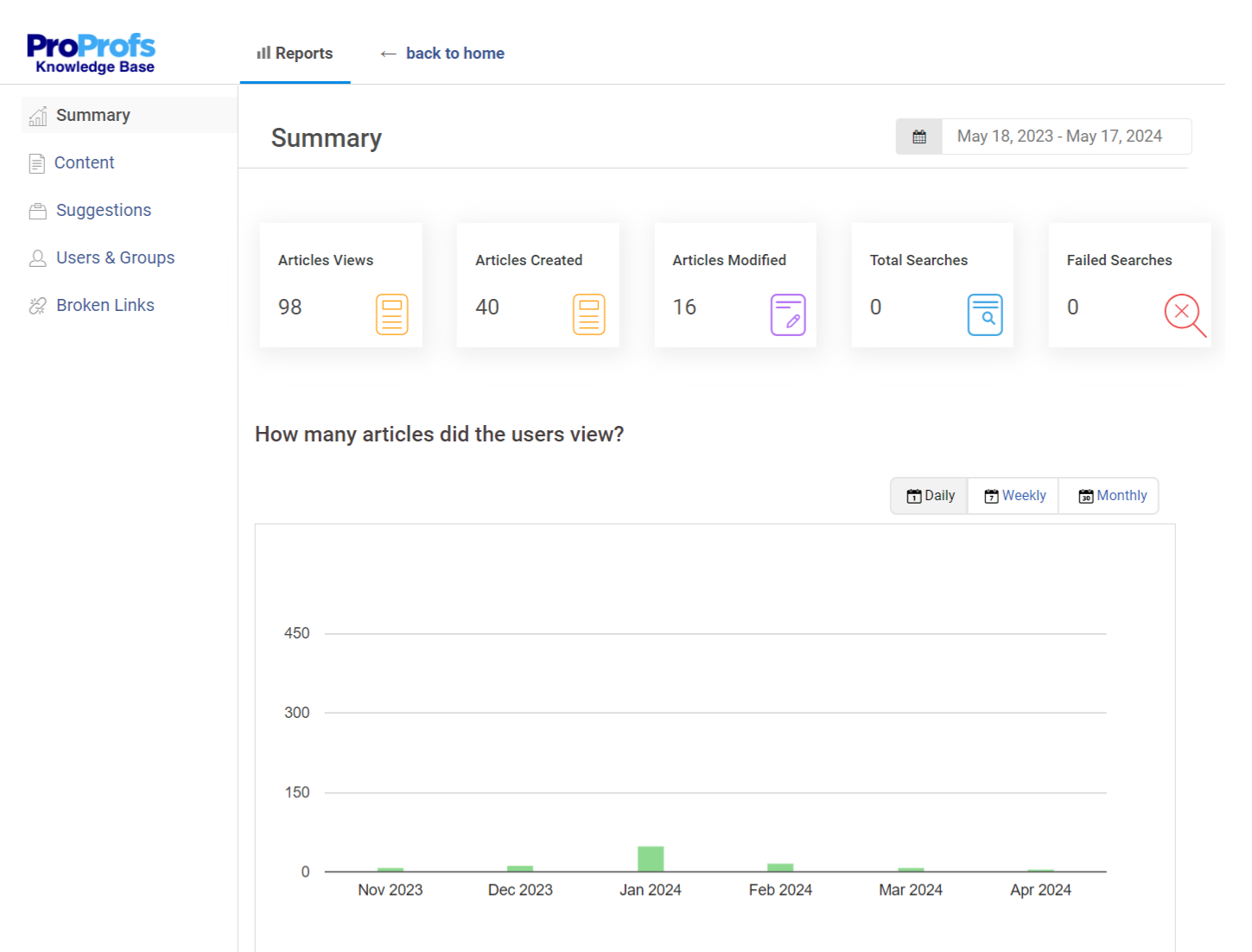

Analytics & Reporting

Tracking key knowledge base usage metrics to measure the KMS’s effectiveness and identify improvement areas. This includes monitoring content usage, search trends, and user engagement.

Why Is Knowledge Management Important to Financial Institutions?

Knowledge management is imperative for navigating today’s complex and dynamic economic landscape. Here’s why it’s so vital:

Enhanced Decision-Making

Knowledge management systems provide a centralized repository of financial data, market research, regulatory updates, and expert analysis, empowering financial professionals to make informed decisions quickly and confidently.

Improved Risk Management

Financial institutions are susceptible to market volatility and regulatory compliance. Knowledge management helps mitigate these risks by providing access to risk management frameworks, best practices, and lessons learned from past experiences.

Increased Efficiency & Productivity

Financial institutions often grapple with complex processes and workflows. Knowledge management streamlines these processes by providing easy access to information, automating tasks, and facilitating team collaboration.

Streamlined Customer Service

Providing exceptional customer service is crucial for financial institutions. Knowledge management empowers customer-facing teams like support and sales with the information and tools they need to answer customer queries accurately, leading to increased satisfaction and loyalty.

Innovation & Competitive Advantage

Knowledge management enables a culture of innovation by encouraging the sharing of ideas, best practices, and market insights. This allows financial institutions to adapt to changing market conditions, develop new products and services, and gain a competitive edge.

Better Compliance

The financial industry is heavily regulated, and compliance is critical. Knowledge management systems provide a centralized repository for regulatory updates, compliance procedures, and internal policies, ensuring all employees know and adhere to the latest requirements.

Employee Empowerment & Development

Knowledge management empowers employees to develop their skills and expertise by providing easy access to knowledge and fostering a learning culture. This leads to a more knowledgeable and capable workforce better equipped to serve clients and contribute to the organization’s success.

What Knowledge Management Challenges Are Faced by Financial Institutions?

Financial institutions handle sensitive data and require efficient knowledge management (KM) to ensure smooth operations, compliance, and customer satisfaction. Here are some challenges they face:

Resistance to Change

Employees may hesitate to adopt new KM tools or processes due to a lack of training or fear of disrupting existing workflows. This challenge can delay the successful implementation of KM strategies.

Unorganized Knowledge Sources

Information scattered across different platforms or departments makes it difficult to centralize and standardize knowledge. This fragmentation affects collaboration and leads to inefficiencies.

Slower Response Time

Unorganized knowledge repositories can result in delays in accessing critical information. Whether it’s answering customer queries or addressing internal issues, this lag affects productivity and customer satisfaction.

Customer Information Breach

Financial institutions are prime targets for cyberattacks, making data security a top concern. Poor KM practices, like storing sensitive information in unsecured systems or outdated repositories, increase the risk of breaches, leading to loss of trust and legal repercussions.

Ineffective Self-Service Options

When knowledge bases are outdated or hard to navigate, self-service portals for customers become ineffective. This forces customers to seek assistance from support teams, increasing workload and reducing overall customer satisfaction.

Incorrect or Outdated Information

Errors or inconsistencies in stored information can lead to financial mistakes, miscommunication, or non-compliance. Outdated knowledge in training materials or customer communications can affect a financial institution’s reputation and trustworthiness.

Regulatory Compliance Risks

Strict regulations in the finance industry require meticulous documentation and access to accurate, up-to-date information. Poor KM practices can lead to non-compliance, resulting in fines or penalties.

How to Choose the Best Financial Knowledge Management System

Ensure your platform is comprehensive and user-friendly, and can cater to the KM requirements of financial services. Here are some key factors to consider:

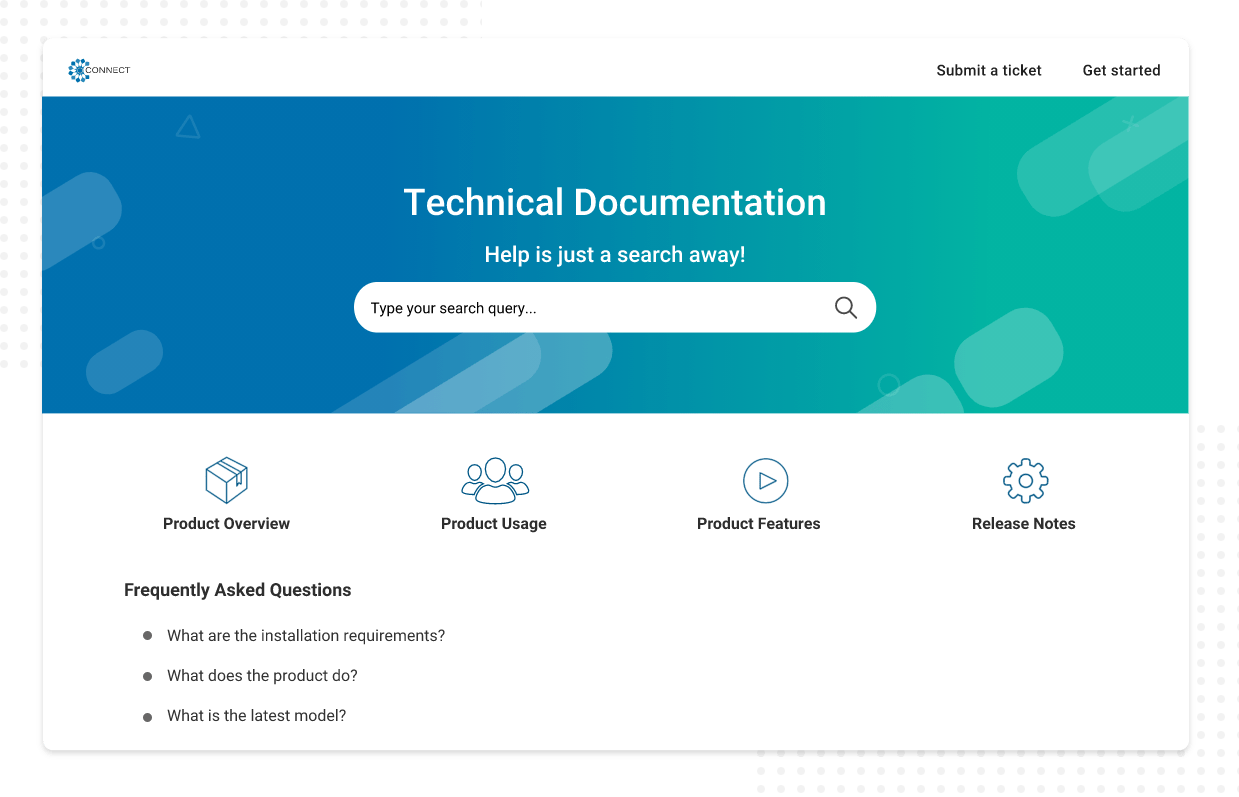

Ease of Use

The KMS should be user-friendly and intuitive, allowing employees to access, contribute to, and share knowledge without requiring extensive training or technical expertise. Look for a system with a clean interface, clear navigation, and simple content creation tools.

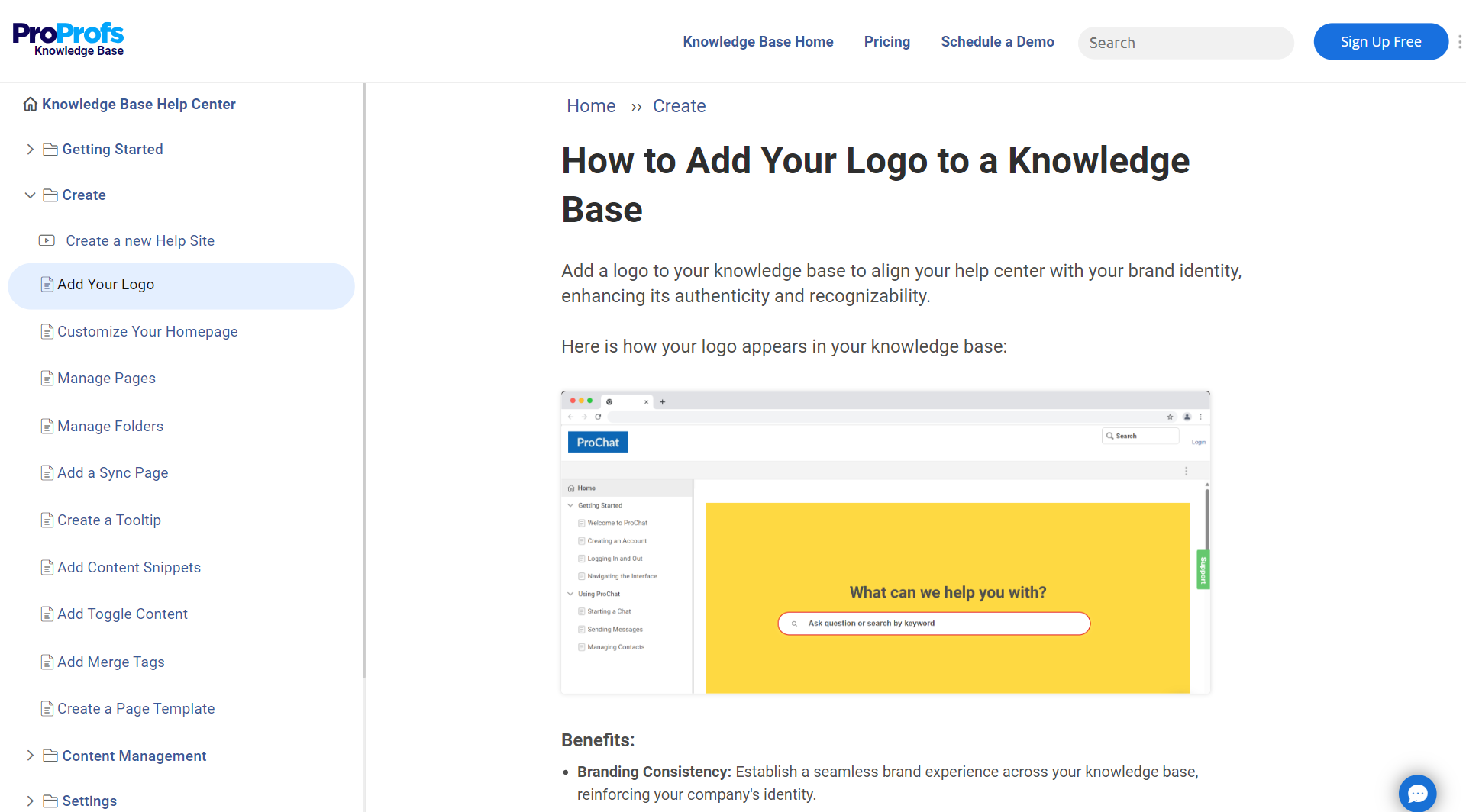

Easy Customization

The KMS should allow for help site customization to fit your institution’s specific needs and branding. This includes tailoring the knowledge base’s look and feel, creating custom workflows, and integrating with existing systems.

Customizable Templates

Pre-built templates for standard financial documents, such as policies, procedures, and reports, can save time and ensure consistency. Choose a KMS that offers a variety of templates that can be easily customized to meet your specific requirements.

AI Capabilities

AI-powered features, like intelligent search, generative AI writing, content tagging, and personalized recommendations, can significantly enhance the efficiency and effectiveness of your KMS.

Consider a system that leverages AI to automate tasks, improve knowledge discovery, and provide relevant information to users.

Team Collaboration

The KMS should enable collaboration tools, allowing teams to co-author documents, share feedback, and engage in discussions with internal comments.

Look for features like version control, commenting, and real-time editing to support collaborative knowledge creation.

Multi-Branding

If your financial institution operates under multiple brands or subsidiaries, consider a KMS that supports multi-branding.

This allows you to create separate knowledge bases for each brand, maintaining consistency and brand identity while managing them from a central platform.

Speaking of multibranding, here’s a great example of how Ayyeka Technologies used ProProfs Knowledge Base for multi-branding. You can also watch the video:

Advanced Search

A robust search functionality is essential for users to find the information they need within the KMS quickly.

Look for a system with advanced search capabilities, such as filtering, faceting, and natural language processing, to ensure accurate and efficient knowledge retrieval.

Security & Privacy

Choose a KMS that offers robust security features, such as encryption, access controls, and audit trails, to protect sensitive financial information and ensure compliance with regulatory requirements.

Improve Customer Service & Compliance with Finance Knowledge Management

Effective knowledge management empowers financial institutions to improve decision-making, enhance efficiency, mitigate risks, and confidently navigate the complexities of the financial landscape.

When choosing a knowledge management system, consider factors like ease of use, customization options, AI capabilities, collaboration features, security measures, and integration with existing systems. Prioritize a system that empowers your team, streamlines workflows, and enhances knowledge sharing throughout your organization.

ProProfs Knowledge Base, with its user-friendly interface, robust features like AI-powered search and customizable templates, and seamless integrations, is an ideal choice for building a knowledge-driven culture within your financial institution. You can explore the tool more or request a demo below.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!